Six Questions With BHGAP Graduate Nancy Jiayi Hou

Meet Fall 2023 Berkeley Haas Global Access Program graduate Nancy Jiayi Hou. Currently completing her final year at The Chinese University of Hong Kong, Shenzhen, pursuing a degree in finance, Nancy is wrapping up her studies in global financial markets and investment strategies.

To supplement this deep learning, Nancy has participated in several internships, both before and after her visiting-student experience at Berkeley:

- Risk management analyst at Lianchu Securities Co Ltd.

- Strategic business development at China Industrial Securities International Financial Group Limited

- Investment manager at Haitong Capital

- Assistant asset manager at CITIC Securities

Each of these experiences gave Nancy a deeper dive into understanding market inefficiencies and asset allocation.

I had the pleasure of chatting with Nancy to learn more about her experience in BHGAP.

1. Why did you choose our Berkeley Haas Global Access Program?

I chose this program because of its strong focus on innovation and entrepreneurship, which complements my finance background. The program's reputation for fostering an entrepreneurial mindset and its Silicon Valley connections were key factors that drew me to Berkeley. I wanted to gain exposure to a global business environment and learn how cutting-edge financial strategies are applied in the U.S. market.

2. What was your experience with Haas classes?

I took Opportunity Recognition: Technology and Entrepreneurship in Silicon Valley, Innovation and Entrepreneurship for Sustainability, Advanced Financial Accounting and Introduction to MATLAB. These courses provided a unique blend of financial rigor and entrepreneurial thinking, offering insights into how technological innovations drive business growth.

The courses I selected were a perfect extension of my finance major, allowing me to apply what I had learned in investment analysis to the broader context of entrepreneurship and technological innovation. For example, Advanced Financial Accounting strengthened my technical skills, while Opportunity Recognition allowed me to see how finance plays a role in driving new ventures in tech industries.

The biggest difference at Berkeley from my home university was the emphasis on practical application and hands-on projects. While my home university provides a strong theoretical foundation in finance, Berkeley’s courses pushed me to think critically and apply knowledge to real-world problems, particularly through case studies and collaborative projects with students from diverse backgrounds.

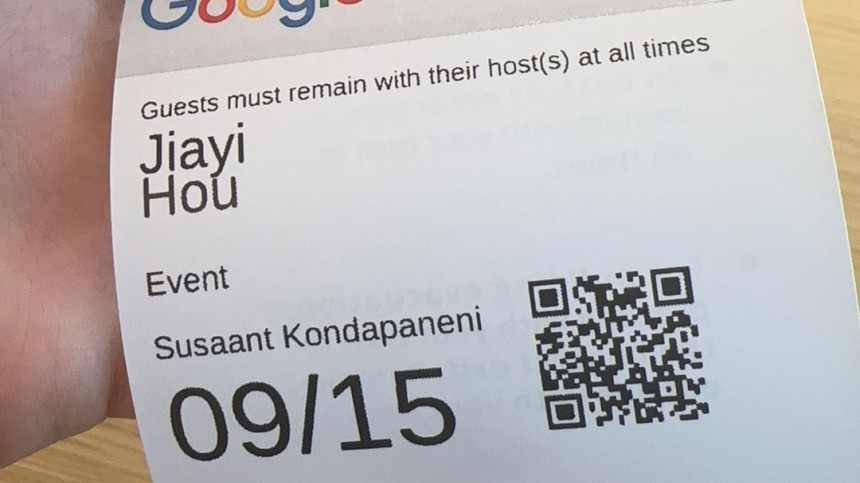

I had the opportunity to visit Google Cloud, which was a standout experience. Seeing how such a major player in the tech industry leverages cloud computing to provide scalable solutions was eye-opening. It reinforced the importance of technology in transforming industries—including finance—and gave me a better understanding of how data-driven insights and cloud technology are being integrated into business strategies across sectors.

Berkeley’s courses pushed me to think critically and apply knowledge to real-world problems, particularly through case studies and collaborative projects with students from diverse backgrounds.

3. You also did some sightseeing. What were your favorite spots to explore?

I especially enjoyed hiking in the Berkeley Hills and visiting iconic spots like the Golden Gate Bridge and Fisherman’s Wharf. Exploring the tech hubs in San Francisco also gave me a better sense of the innovative culture in the Bay Area.

I also enjoyed touring the UC Berkeley campus and experiencing its rich academic culture, as well as walking around downtown San Francisco to get a feel for the city’s vibrant, tech-driven atmosphere.

4. Did you also take advantage of the career coaching?

The coaching was incredibly insightful, particularly in refining my personal branding and preparing for interviews. It gave me clarity on how to articulate my strengths and experiences in a global context, which has been valuable in navigating my career path.

5. What advice would you give to someone who is starting BHGAP on how to best succeed?

Be open to collaboration and learning from others, as you’ll meet people from diverse backgrounds. Make the most of the opportunities to engage with professors and industry experts. Also, don’t be afraid to push yourself outside your comfort zone, both academically and socially.

6. Where can we find you in five years?

I see myself leading a private equity team, focusing on cross-border investments in sustainable industries. I hope to be leveraging the insights I’ve gained from both Berkeley and my finance background to drive innovative financial solutions in sectors like renewable energy.